Candlestick Inverted Hammer Pattern

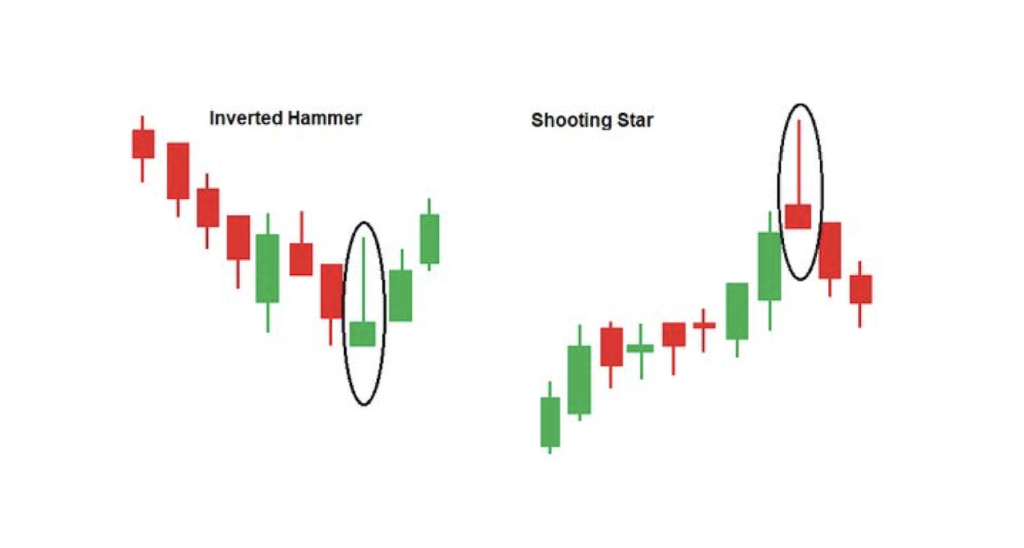

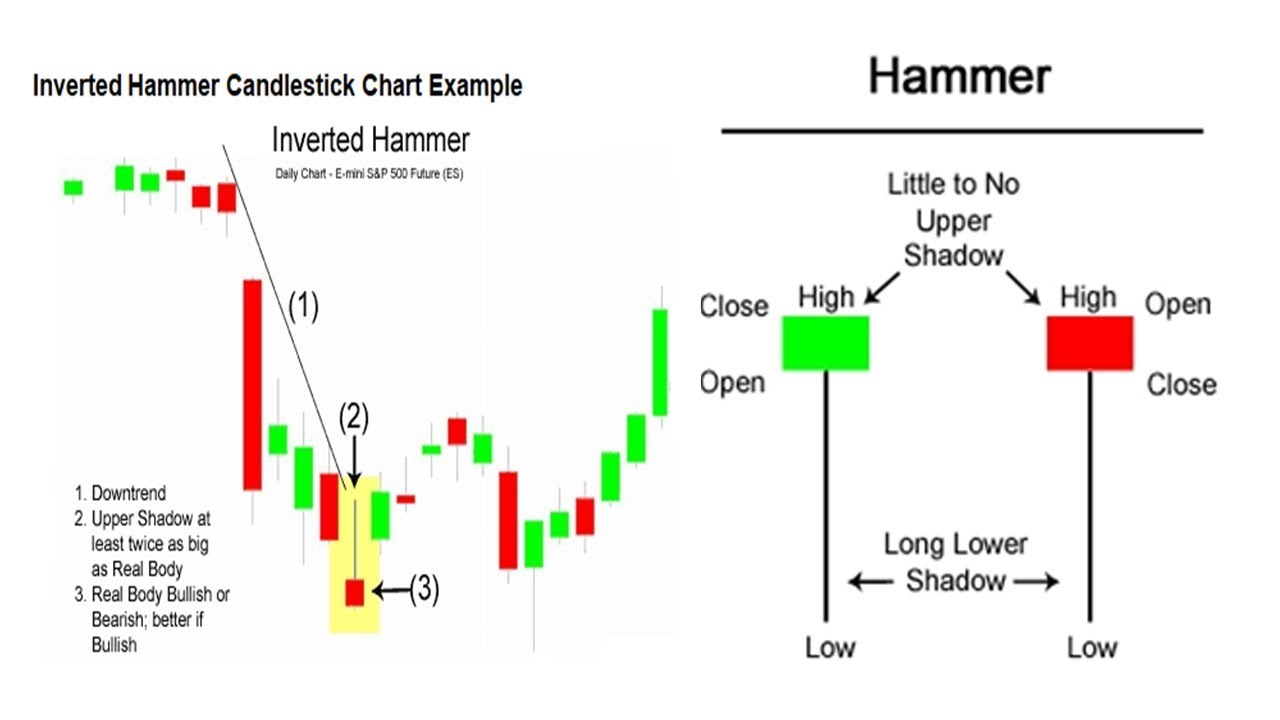

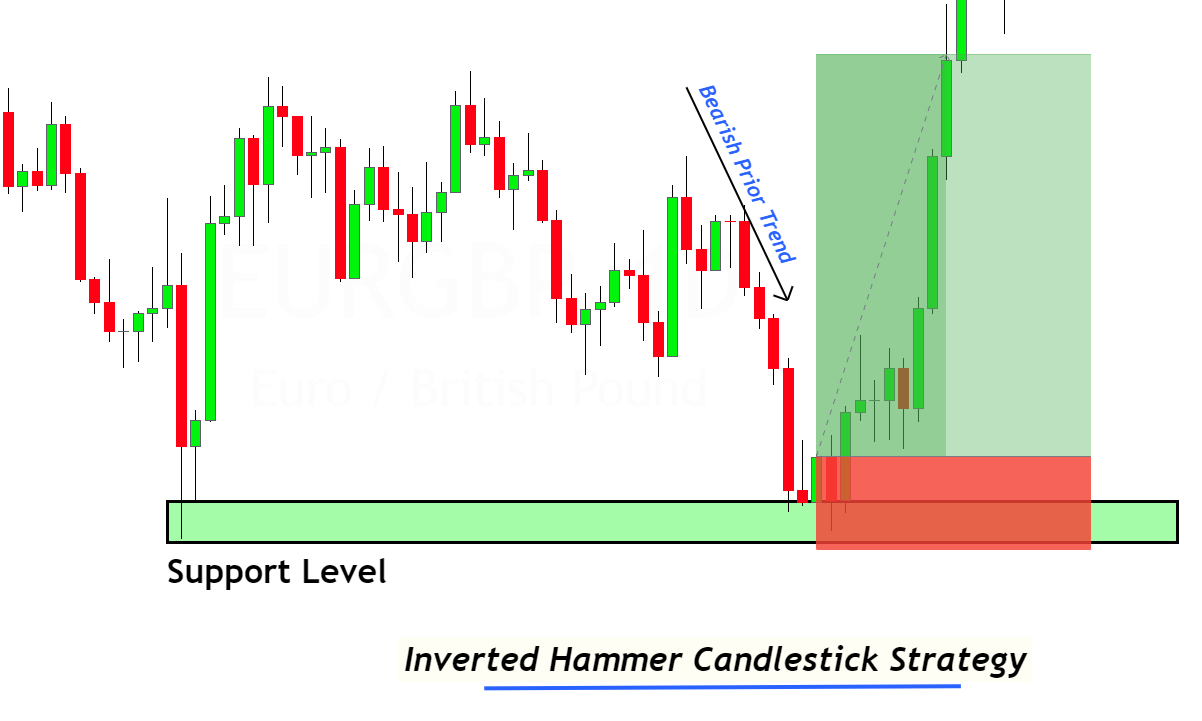

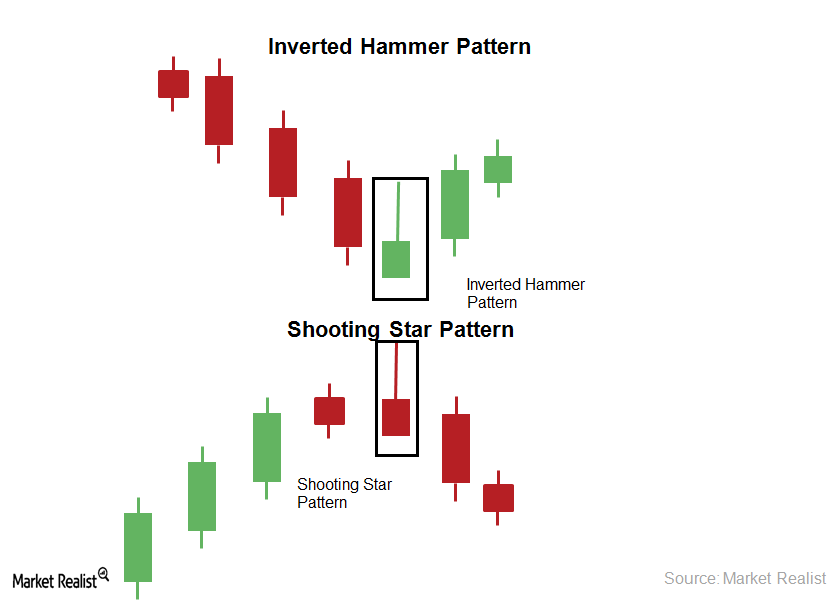

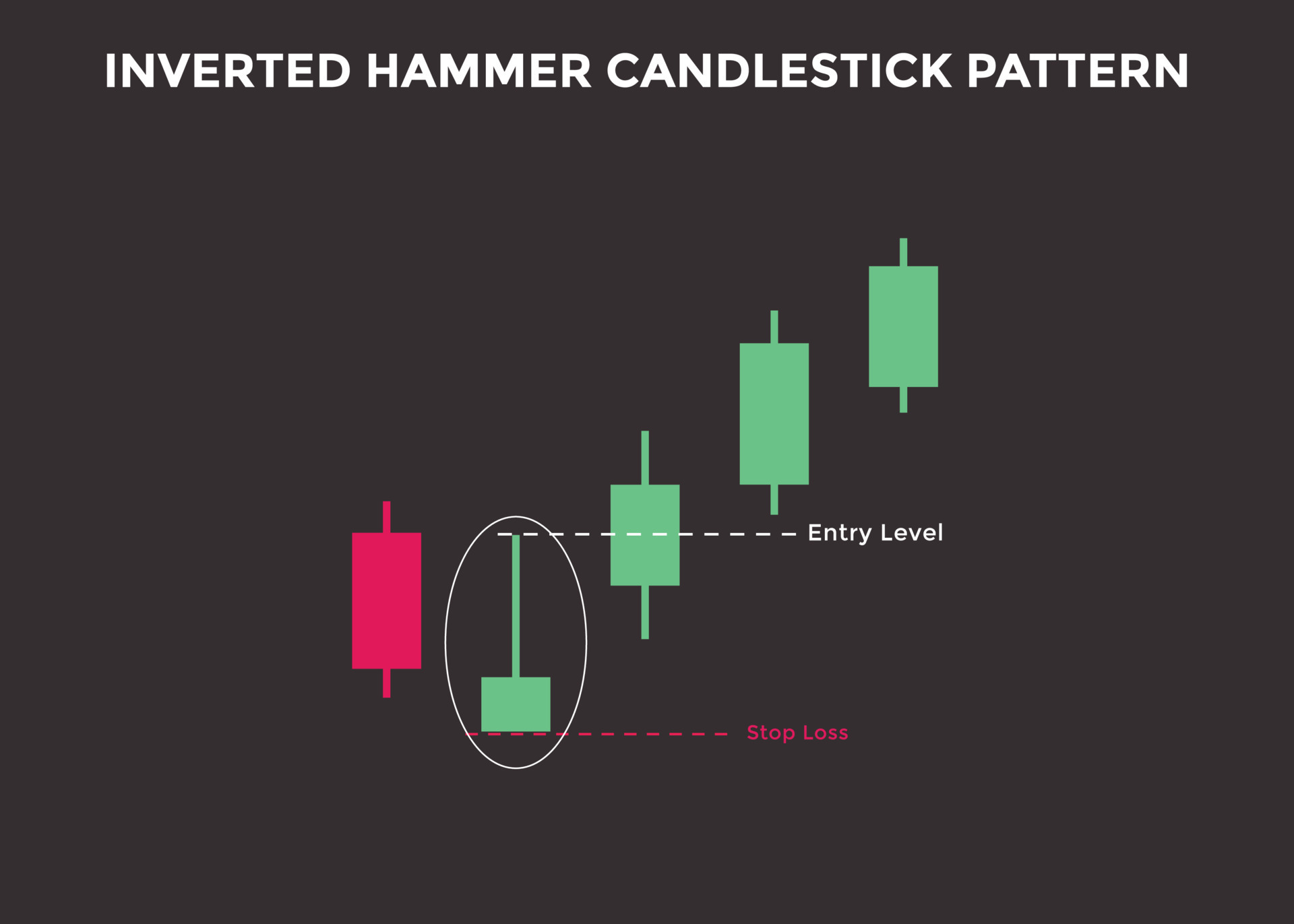

Candlestick Inverted Hammer Pattern - How to use the inverted hammer candlestick pattern in trading? “isn’t the inverted hammer considered bullish?” It signals a potential reversal of price, indicating the initiation of a bullish trend. Web how to spot an inverted hammer candlestick pattern: Web how to use an inverted hammer candlestick pattern in technical analysis. Web what is an inverted hammer pattern in candlestick analysis? Now wait, i know what you’re thinking! Hammer candlestick inverted hammer candlestick pattern illustration. Candle with a small real body, a long upper wick and little to no lower wick. It signals a potential bullish reversal. How to identify an inverted hammer candlestick pattern? In this guide to understanding the inverted hammer candlestick pattern, we’ll show you what this chart looks like, explain its components, teach you how to interpret it with an example, and how to trade on it. Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of bullish reversal candlestick formation that occurs at the end of a downtrend and signals a price trend reversal. Web the inverted hammer candlestick pattern is valuable for traders to identify potential trend reversals from bearish to bullish. Web how to spot an inverted hammer candlestick pattern: That is why it is called a ‘bullish reversal’ candlestick pattern. First, the candle must occur after a downtrend. Web what is an inverted hammer pattern in candlestick analysis? Web the hammer candlestick as shown above is a bullish reversal pattern that signals a potential price bottom followed by an upward move. How to use the inverted hammer candlestick pattern in trading? Web an inverted hammer candlestick refers to a technical analysis chart pattern that typically appears on a price chart when buyers in the market generate enough pressure to drive up an asset’s price. Web what is the inverted hammer? A long lower shadow, typically two times or more the length of the body. Web the hammer is a bullish reversal. Web an inverted hammer candlestick refers to a technical analysis chart pattern that typically appears on a price chart when buyers in the market generate enough pressure to drive up an asset’s price. This is a reversal candlestick pattern that appears at the bottom of a downtrend and. Web inverted hammer candlesticks are bullish candlestick patterns that form at the. If you’re following traditional inverted hammer candlestick strategies, you’re likely losing money if you’re using the standard entry. Web the inverted hammer candlestick pattern is a powerful tool for traders looking to identify trend reversals and potential buying opportunities. Second, the upper shadow must be at least two times the size of the real body. Characterized by its distinctive shape,. That is why it is called a ‘bullish reversal’ candlestick pattern. Web what is an inverted hammer pattern in candlestick analysis? But what is the inverted hammer candlestick pattern, and how can it be used to make profitable trades? Web what is the inverted hammer? Web the hammer candlestick as shown above is a bullish reversal pattern that signals a. Web the inverted hammer candlestick pattern is a chart pattern used in technical analysis to find trend reversals. It often appears at the bottom of a downtrend, signalling potential bullish reversal. Web if you’re trying to identify an inverted hammer candlestick pattern, look for the following criteria: A long lower shadow, typically two times or more the length of the. Third, the lower shadow should either not exist or be very, very small. Typically, it will have the following characteristics: The inverted hammer candlestick pattern is formed on the chart when there is pressure from the bulls (buyers) to push the price of the asset higher. Web what is an inverted hammer pattern in candlestick analysis? Web how to use. First, the candle must occur after a downtrend. Web inverted hammer candlesticks are bullish candlestick patterns that form at the bottom of a downtrend, which signals a potential reversal. Appears at the bottom of a downtrend. How to use the inverted hammer candlestick pattern in trading? It often appears at the bottom of a downtrend, signalling potential bullish reversal. The inverse hammer candlestick and shooting star patterns look identical but are found in different areas. Web the hammer candlestick as shown above is a bullish reversal pattern that signals a potential price bottom followed by an upward move. Typically, it will have the following characteristics: This is a reversal candlestick pattern that appears at the bottom of a downtrend. How to use the inverted hammer candlestick pattern in trading? Web the inverted hammer candlestick is a single candle pattern that signals a potential bullish reversal. Typically, it will have the following characteristics: Web the inverted hammer candlestick pattern is a crucial tool in technical analysis, heralding potential bullish reversals in bearish markets. Web inverted hammer candlesticks are bullish candlestick. Web inverted hammer vs. Web how to use an inverted hammer candlestick pattern in technical analysis. Pros and cons of the. Web an inverted hammer candlestick refers to a technical analysis chart pattern that typically appears on a price chart when buyers in the market generate enough pressure to drive up an asset’s price. Web the inverted hammer candlestick pattern. It appears during downtrends and signals the possibility of a bullish reversal when the market participants are starting to gain control over the bears. Typically, it will have the following characteristics: It often appears at the bottom of a downtrend, signalling potential bullish reversal. A long lower shadow, typically two times or more the length of the body. Web the inverted hammer candlestick pattern (or inverse hammer) is a candlestick that appears on a chart when there is pressure from buyers to push an asset’s price up. Web the inverted hammer candlestick pattern, also known as the inverse hammer pattern, is a type of bullish reversal candlestick formation that occurs at the end of a downtrend and signals a price trend reversal. “isn’t the inverted hammer considered bullish?” Now wait, i know what you’re thinking! Pros and cons of the. If you’re following traditional inverted hammer candlestick strategies, you’re likely losing money if you’re using the standard entry. What is meant by the inverted hammer candlestick? Web the inverted hammer candlestick pattern is a crucial tool in technical analysis, heralding potential bullish reversals in bearish markets. Web what is the inverted hammer? Web how to spot an inverted hammer candlestick pattern: The body of the candle is short with a longer lower shadow. Hammer candlestick inverted hammer candlestick pattern illustration.How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Tutorial on How to Trade the Inverted Hammer signalHammer and inverted

Inverted Hammer Candlestick How to Trade it ForexBoat Trading

Bullish Inverted Hammer Candlestick Pattern ForexBee

The Inverted Hammer And Shooting Star Candlestick Pattern

Inverted Hammer Candlestick Pattern Quick Trading Guide

Inverted Hammer candlestick chart pattern. Candlestick chart Pattern

How to Read the Inverted Hammer Candlestick Pattern? Bybit Learn

Inverted Hammer Candlestick Pattern PDF Guide Trading PDF

Inverted Hammer Candlestick Pattern Forex Trading

It Signals A Potential Bullish Reversal.

Web The Inverted Hammer Candlestick Pattern Is A Powerful Tool For Traders Looking To Identify Trend Reversals And Potential Buying Opportunities.

Web The Inverted Hammer Candlestick Pattern Is A Chart Pattern Used In Technical Analysis To Find Trend Reversals.

Second, The Upper Shadow Must Be At Least Two Times The Size Of The Real Body.

Related Post: