Double Bottom Chart Pattern

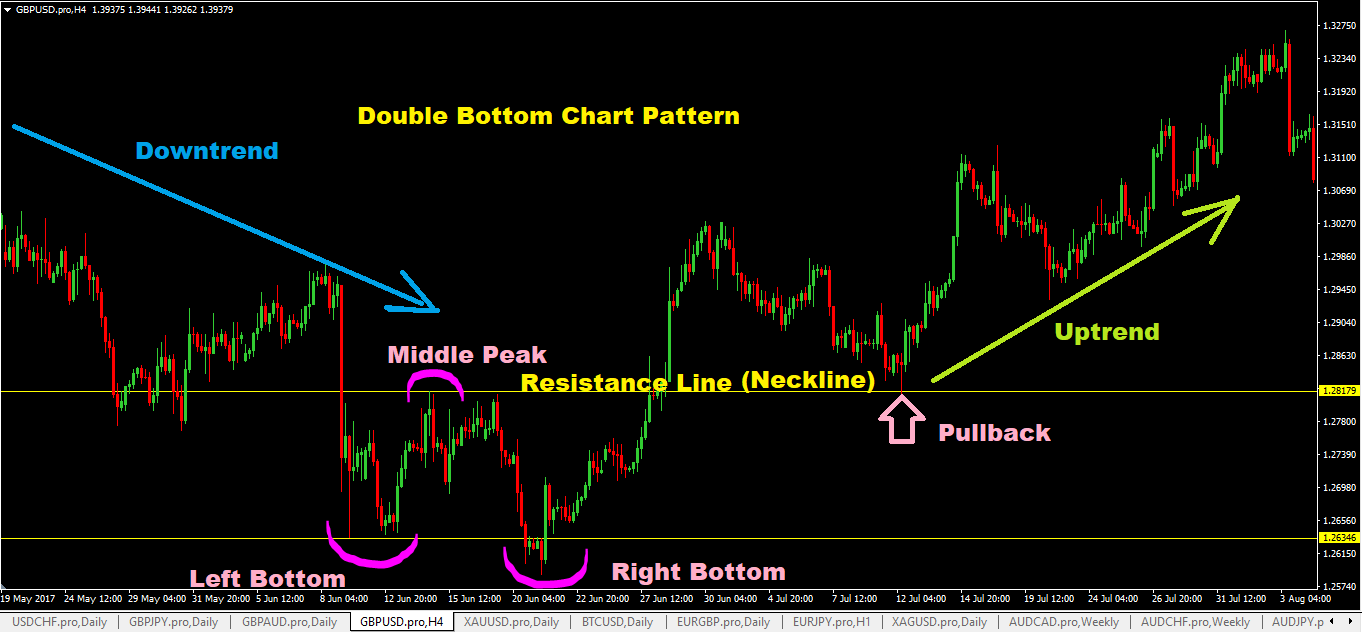

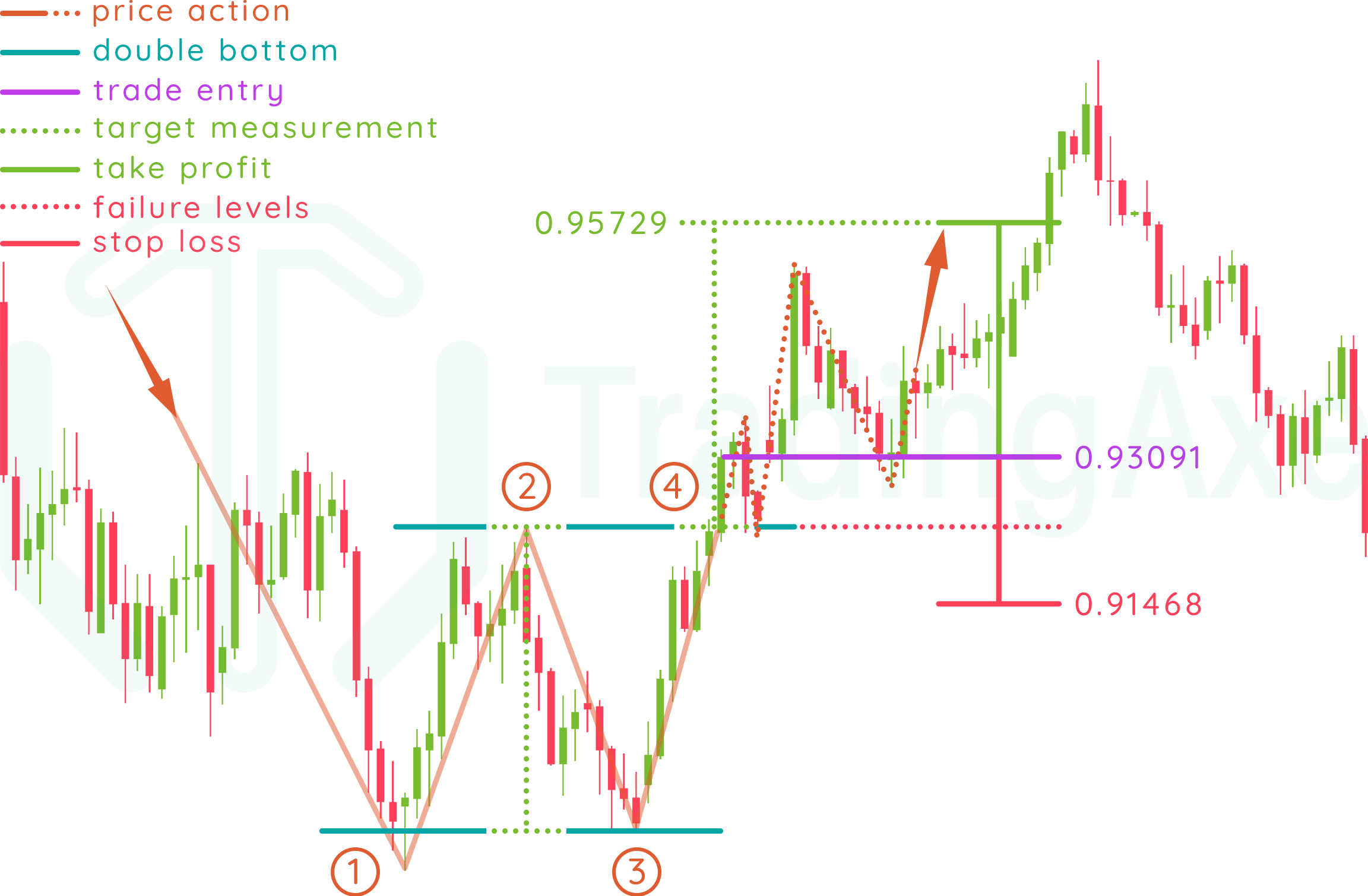

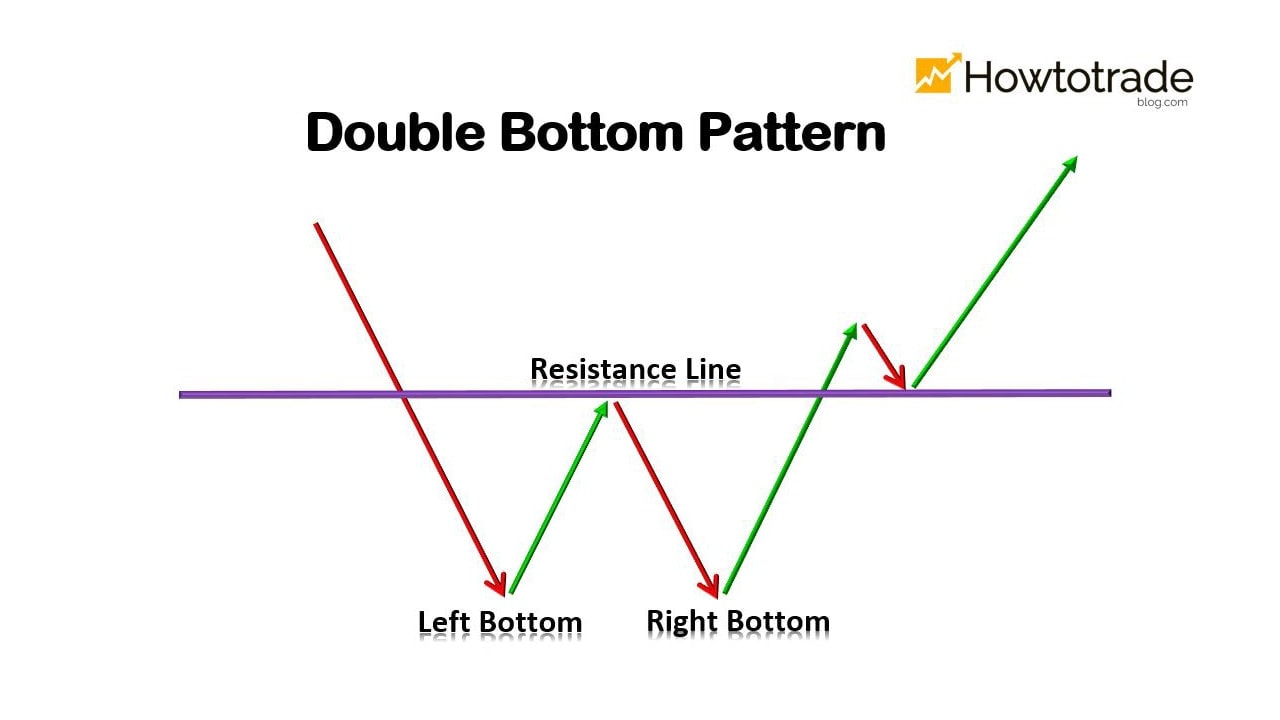

Double Bottom Chart Pattern - Web double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). To create a double bottom pattern, price begins in a downtrend, stops, and then reverses trend. The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. Web a double bottom is a bullish chart pattern in the shape of a w. Web the double bottom is one of the easiest chart patterns to trade, which makes it perfect for beginners or anyone who wants to quickly add another profitable set up to their overall trading strategy. Identify the two distinct bottoms of similar width and height. Web the double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts. Web the double bottom chart pattern is a price action formation on the chart that consists of two swing lows that end around the same level, and a swing high between them. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. Web the double bottom technical analysis charting pattern is a common and highly effective price reversal pattern. Web the double bottom is one of the easiest chart patterns to trade, which makes it perfect for beginners or anyone who wants to quickly add another profitable set up to their overall trading strategy. Web double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). Web a double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market trading. Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. To trade the pattern, you follow three simple steps: The price successively makes two troughs (lowest points) at approximately the same level, indicating significant support. Web if you’re interested in finding profitable opportunities with a double bottom pattern, this guide will first explain what a double bottom pattern is, how to identify one, and finally, how to trade a double bottom chart formation. Web the double bottom chart pattern is a price action formation on the chart that consists of two swing lows that end around the same level, and a swing high between them. Web the double bottom pattern is a bullish reversal chart pattern that occurs at the end of a downtrend and signals a possible trend reversal. Web the double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts. Web a double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market trading. To create a double bottom pattern, price begins in. Web the double bottom pattern is a bullish reversal chart pattern that occurs at the end of a downtrend and signals a possible trend reversal. The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. But how to identify and trade the double bottom pattern in financial. Web the double bottom technical analysis charting pattern is a common and highly effective price reversal pattern. The pattern is seen in a downtrend and may indicate the end of the downtrend, so it is considered a bullish reversal pattern. Web if you’re interested in finding profitable opportunities with a double bottom pattern, this guide will first explain what a. To trade the pattern, you follow three simple steps: Similar to the double top pattern, it consists of two bottom levels near a support line called the neckline. Web a double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market trading. Web. To trade the pattern, you follow three simple steps: To create a double bottom pattern, price begins in a downtrend, stops, and then reverses trend. Identify the two distinct bottoms of similar width and height. Web if you’re interested in finding profitable opportunities with a double bottom pattern, this guide will first explain what a double bottom pattern is, how. Web if you’re interested in finding profitable opportunities with a double bottom pattern, this guide will first explain what a double bottom pattern is, how to identify one, and finally, how to trade a double bottom chart formation. Web the double bottom technical analysis charting pattern is a common and highly effective price reversal pattern. Web double top and bottom. Web the double bottom pattern is a bullish reversal chart pattern that occurs at the end of a downtrend and signals a possible trend reversal. But how to identify and trade the double bottom pattern in financial markets trading? Identify the two distinct bottoms of similar width and height. Similar to the double top pattern, it consists of two bottom. But how to identify and trade the double bottom pattern in financial markets trading? The price successively makes two troughs (lowest points) at approximately the same level, indicating significant support. Web the double bottom pattern is a bullish reversal chart pattern that occurs at the end of a downtrend and signals a possible trend reversal. To trade the pattern, you. Web the double bottom pattern is a trend reversal pattern observed on charts, such as bar and japanese candlestick charts. But how to identify and trade the double bottom pattern in financial markets trading? Web the double bottom chart pattern is a price action formation on the chart that consists of two swing lows that end around the same level,. Web a double bottom is a bullish chart pattern in the shape of a w. Identify the two distinct bottoms of similar width and height. Web a double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market trading. Web the double bottom. Web the double bottom pattern is a bullish reversal chart pattern that occurs at the end of a downtrend and signals a possible trend reversal. Web double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). But how to identify and trade the double bottom pattern in financial markets trading? Web the double bottom is one of the easiest chart patterns to trade, which makes it perfect for beginners or anyone who wants to quickly add another profitable set up to their overall trading strategy. The price successively makes two troughs (lowest points) at approximately the same level, indicating significant support. Identify the two distinct bottoms of similar width and height. Web the double bottom technical analysis charting pattern is a common and highly effective price reversal pattern. To create a double bottom pattern, price begins in a downtrend, stops, and then reverses trend. To trade the pattern, you follow three simple steps: Web a double bottom is a bullish chart pattern in the shape of a w. Web the double bottom chart pattern is a price action formation on the chart that consists of two swing lows that end around the same level, and a swing high between them. Web a double bottom pattern is a classic technical analysis charting formation that represents a major change in trend and a momentum reversal from a prior down move in market trading.How To Trade Double Bottom Chart Pattern TradingAxe

Double Bottom Pattern A Trader’s Guide

Double Bottom Chart Pattern Forex Trading Strategy

Double Bottom Pattern Rules and Example StockManiacs

How To Trade Double Bottom Chart Pattern TradingAxe

To All The New Members In The AMPSub...Please Continue To Be Humble

Double Bottom Pattern New Trader U

Forex Double Bottom How To Trade The Double Bottom Chart Pattern Fx

DOUBLE BOTTOM CHART PATTERN FREE CHART PATTERN COURSES TECHNICAL

Double Bottom Chart Pattern Best Analysis

Web The Double Bottom Pattern Is A Trend Reversal Pattern Observed On Charts, Such As Bar And Japanese Candlestick Charts.

The Pattern Is Seen In A Downtrend And May Indicate The End Of The Downtrend, So It Is Considered A Bullish Reversal Pattern.

Similar To The Double Top Pattern, It Consists Of Two Bottom Levels Near A Support Line Called The Neckline.

Web If You’re Interested In Finding Profitable Opportunities With A Double Bottom Pattern, This Guide Will First Explain What A Double Bottom Pattern Is, How To Identify One, And Finally, How To Trade A Double Bottom Chart Formation.

Related Post: