Evening Star Candle Pattern

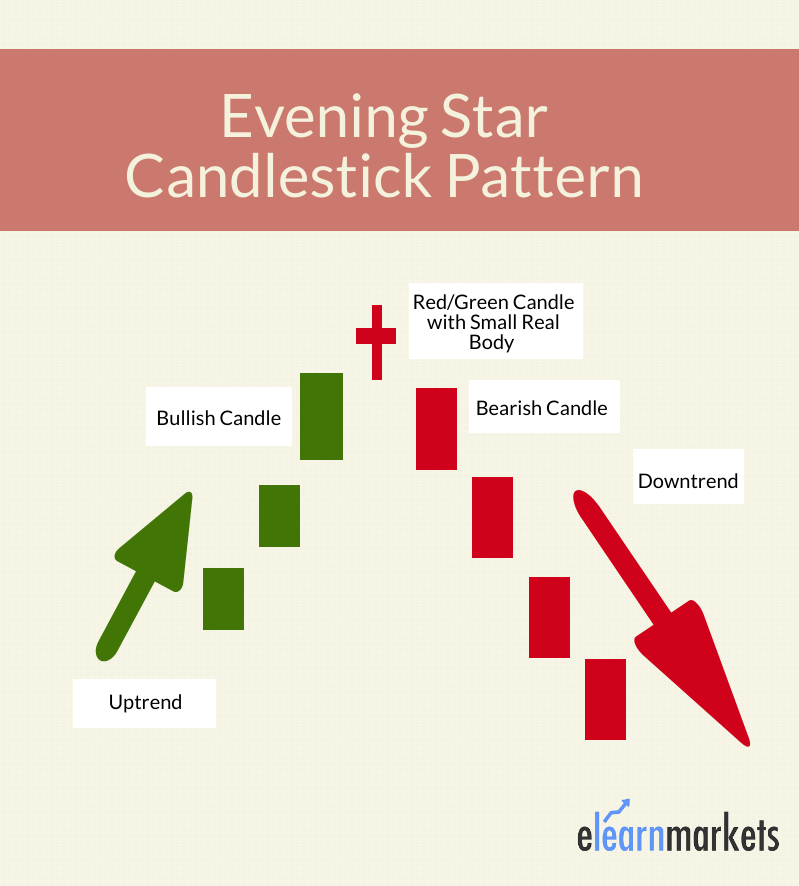

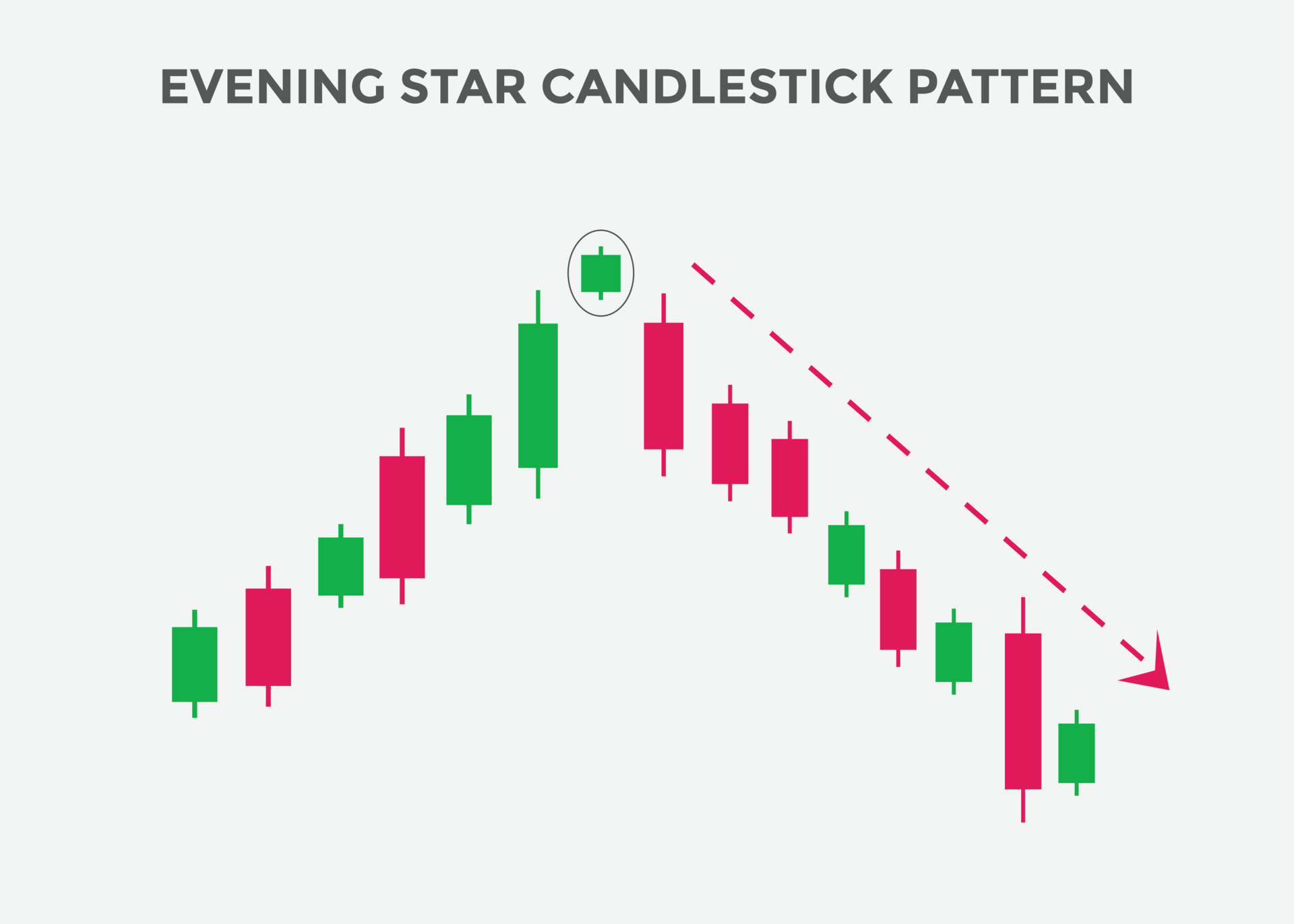

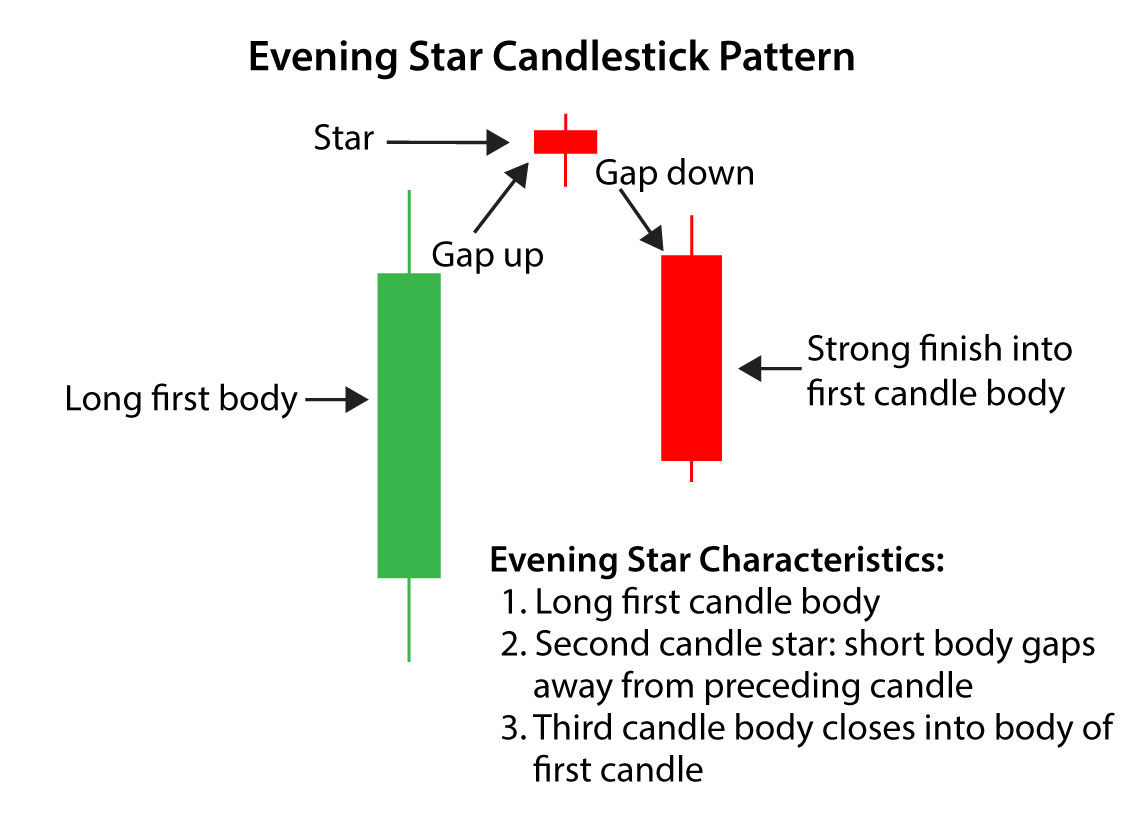

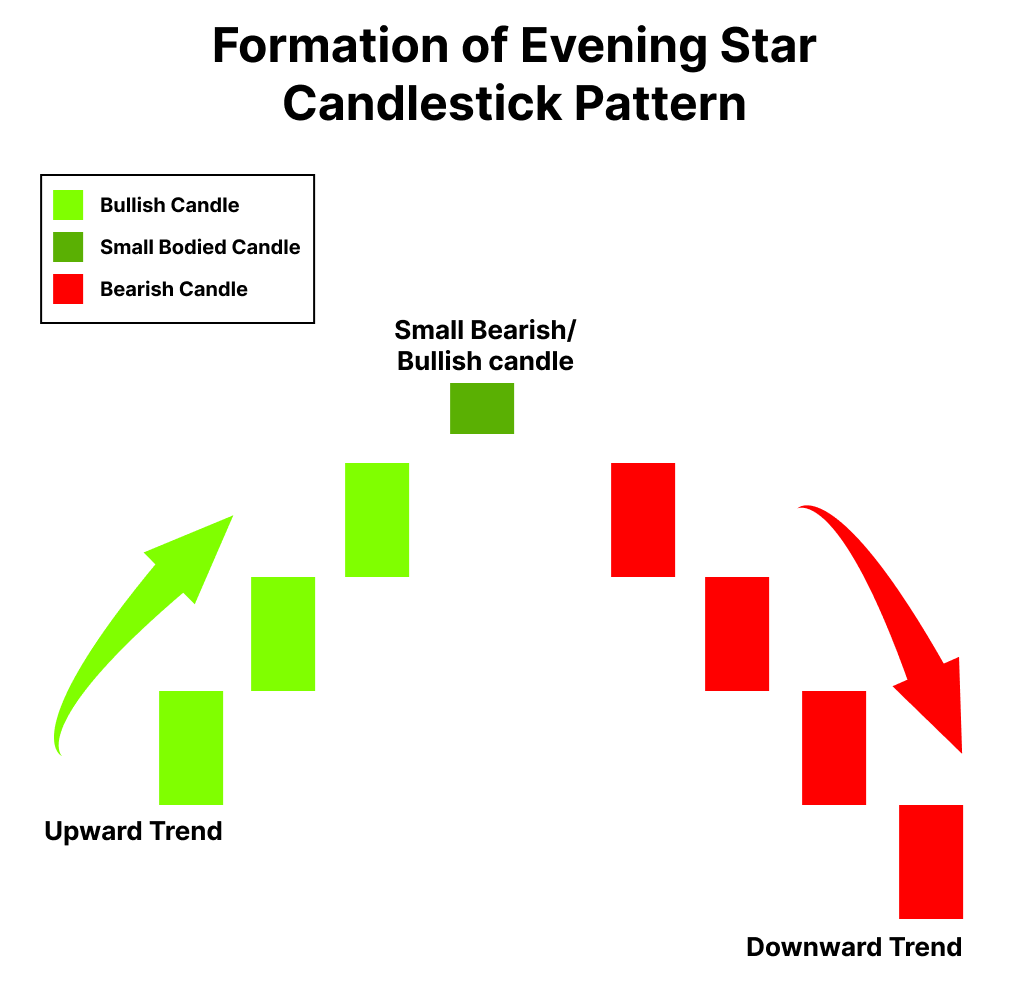

Evening Star Candle Pattern - The best evening star trading strategy is a bullish mean reversion strategy in the stock and crypto markets and a bearish mean reversion strategy in the forex market. Evening star patterns appear at the top of a price uptrend, signalling that the uptrend is going to end. Consisting of three candles, the pattern usually forms at the end of an uptrend, suggesting a possible downturn in the market. Don't forget to like, share, and. Web the evening star is a bearish reversal pattern in technical analysis that is identified by a tall bullish candle followed by a small candle that gaps above the first candle, and then a third candle that is bearish and closes below the midpoint of the first candle. The first candle is long and bullish and continues the uptrend; Web the evening star pattern is viewed as a bearish reversal pattern in technical analysis. Web the evening star candle pattern is a bearish reversal signal in technical analysis, providing traders with potential insight into market momentum shifts. 3 benefits of the evening star candlestick pattern. It's a bearish candlestick pattern that consists of three. A long bullish candle, followed by a short candle or a doji that gaps above the first candle, and finally a long bearish candle that falls into the body of the first candle. 2.2 how does the evening star pattern work? It usually occurs at the top of an uptrend. The first one is a bullish candlestick that affirms the market is in an uptrend backed by bullish momentum. The pattern usually forms over three days. The first line is any white candle appearing as a long line in an uptrend: Web what is an evening star candlestick pattern? The second candle is short and gaps up from the first one; This guide explains what the evening star pattern is and how to recognize and interpret it with the help of an example chart and trade. Web the evening star pattern is viewed as a bearish reversal pattern in technical analysis. 2.2 how does the evening star pattern work? Web an evening star is a three candle bearish reversal pattern that forms after an uptrend, and signals that the bullish trend is coming to an end and will give room for bearish developments. Web trading morning and evening star candlestick patterns |there are more than 100 patterns based on japanese candlesticks.. Web the evening star is a bearish reversal pattern in technical analysis that is identified by a tall bullish candle followed by a small candle that gaps above the first candle, and then a third candle that is bearish and closes below the midpoint of the first candle. Web an evening star is a three candle bearish reversal pattern that. The best evening star trading strategy is a bullish mean reversion strategy in the stock and crypto markets and a bearish mean reversion strategy in the forex market. 3 benefits of the evening star candlestick pattern. Web the evening star pattern is a bearish candlestick pattern used in technical analysis to predict a potential reversal in a bullish market. The. Web the evening star candle pattern is a bearish reversal signal in technical analysis, providing traders with potential insight into market momentum shifts. 4 evening star pattern example. As such, it usually appears at the end of an uptrend and beginning of a downtrend. The second candlestick covers half of the first candle with the dark cloud cover. Evening star. What to do in the evening in orlando??? It usually occurs at the top of an uptrend. The pattern usually forms over three days. The first line is any white candle appearing as a long line in an uptrend: Web the evening star candle pattern is a bearish reversal signal in technical analysis, providing traders with potential insight into market. Web the evening star is a bearish reversal pattern in technical analysis that is identified by a tall bullish candle followed by a small candle that gaps above the first candle, and then a third candle that is bearish and closes below the midpoint of the first candle. This pattern can help you make informed decisions and capture profitable trades. Web 1 the stock market battlefield. Web trading morning and evening star candlestick patterns |there are more than 100 patterns based on japanese candlesticks. Web by the end of this video, you'll have a comprehensive understanding of the evening star candlestick pattern and how to effectively use it in your trading. Web evening star is a bearish reversal candlestick that. It consists of three candlesticks: It consists of three candles: 4.2 three inside up and down. The second candle is short and gaps up from the first one; This is a bearish reversal signal and was established a whisker south of resistance: Web what is an evening star candlestick pattern? As such, it usually appears at the end of an uptrend and beginning of a downtrend. The first one is a bullish candlestick that affirms the market is in an uptrend backed by bullish momentum. Explore orlando evening star online newspaper archive. It consists of three candlesticks: It signals the slowing down of upward momentum before a bearish. 4 evening star pattern example. Web what is an evening star candlestick pattern? Web an evening star is a candlestick pattern that is used by technical analysts for analyzing when a trend is about to reverse. Evening star formation at resistance on s&p 500. The first one is a bullish candlestick that affirms the market is in an uptrend backed by bullish momentum. Channel resistance (taken from the high of 5,325) and a 1.272% fibonacci projection ratio at. This pattern can help you make informed decisions and capture profitable trades correctly. 2.2 how does the evening star pattern work? Web an evening star is a stock price chart pattern that's used by technical analysts to detect when a trend is about to reverse. Web candles set in rather plain iron brackets are used ou the side walls with no central illumination. The second candle is short and gaps up from the first one; The first candle is long and bullish and continues the uptrend; Web the evening star pattern is a bearish candlestick pattern used in technical analysis to predict a potential reversal in a bullish market. Consisting of three candles, the pattern usually forms at the end of an uptrend, suggesting a possible downturn in the market. Web trading morning and evening star candlestick patterns |there are more than 100 patterns based on japanese candlesticks. It's a bearish candlestick pattern that consists of three. The pattern is made up of three main candlesticks. The pattern usually forms over three days. The evening star candlestick pattern is recognized if: Web the evening star is a bearish reversal pattern in technical analysis that is identified by a tall bullish candle followed by a small candle that gaps above the first candle, and then a third candle that is bearish and closes below the midpoint of the first candle.What Is Evening Star Pattern Formation With Examples ELM

How to Trade the Evening Star Candlestick Pattern

How To Trade Blog What Is Evening Star Candlestick Pattern? Meaning

How To Trade Blog What Is Evening Star Candlestick Pattern? Meaning

evening star chart candlestick pattern. Powerful bearish Candlestick

Evening Star Candlestick Pattern How to Trade It in 7 Steps Timothy

What Is Evening Star Pattern & How to Identify It? Finschool

What Is Evening Star Pattern Formation With Examples ELM

Evening Star Candlestick pattern How to Identify Perfect Evening Star

How To Trade Blog What Is Evening Star Candlestick Pattern? Meaning

2.1 What Is The Morning Star Pattern?

Evening Star Patterns Appear At The Top Of A Price Uptrend, Signalling That The Uptrend Is Going To End.

This Guide Explains What The Evening Star Pattern Is And How To Recognize And Interpret It With The Help Of An Example Chart And Trade.

As Such, It Usually Appears At The End Of An Uptrend And Beginning Of A Downtrend.

Related Post: