Rising Flag Pattern

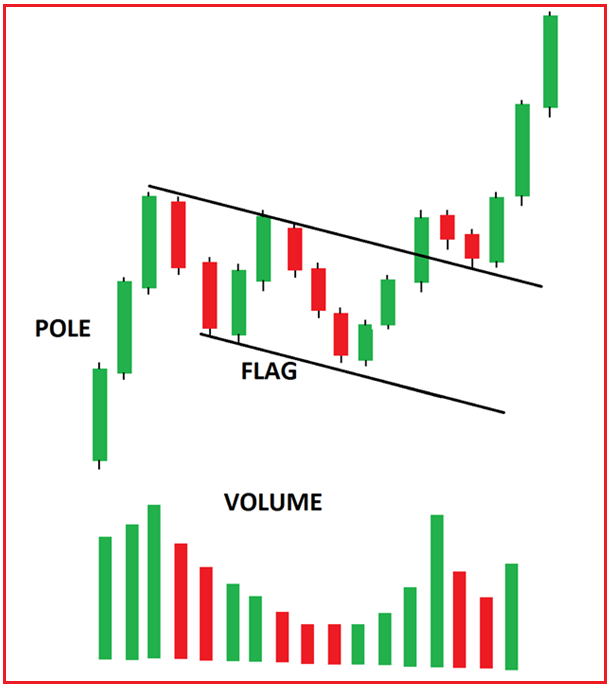

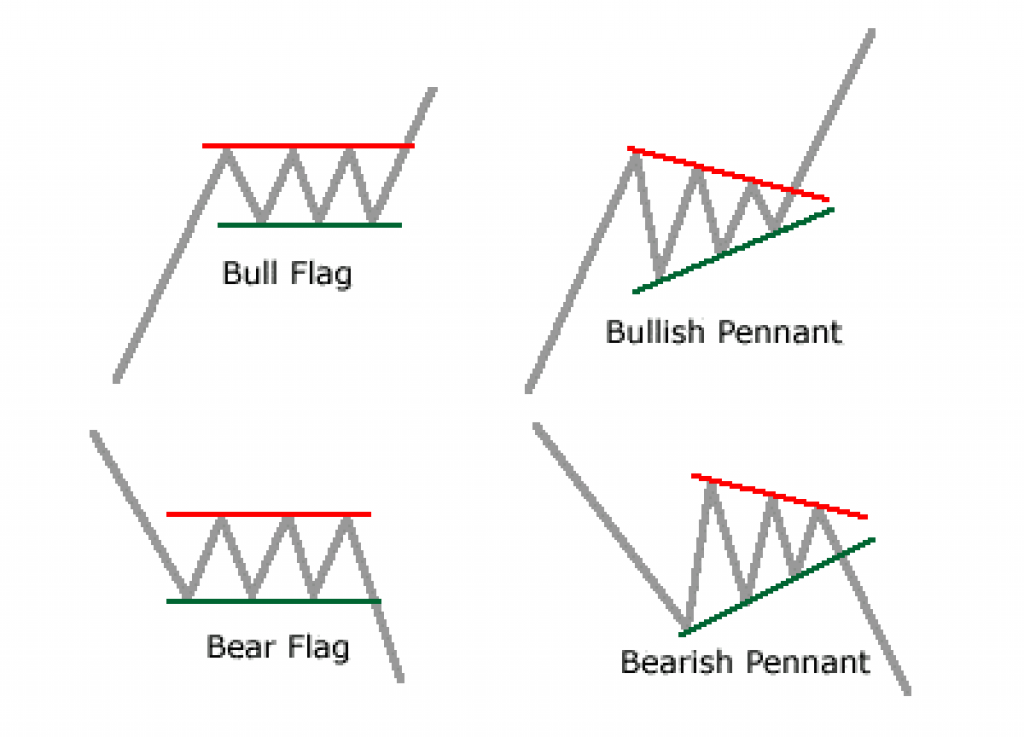

Rising Flag Pattern - It then breaks that range and continues in the original. After an uptrend it has a downward slope and. It is called a flag pattern because it resembles a flag and. Web the flag pattern occurs when a sharply trending price suddenly pauses and retraces slightly in a rectangular range. Learn how to identify, trade and confirm flag patterns, and see examples of bullish and b… The bullish flag pattern is usually found in assets with a strong uptrend. Find out how to confirm,. Web the rising wedge is a chart pattern used in technical analysis to predict a likely bearish reversal. Web to identify the flag pattern, you need to spot the flagpole, recognize the flag, and confirm the breakout. Web trump rally shooting. See chart examples, volume analysis and tips. Photo of bloodied trump fist pumping immediately spotlighted by his allies “praying for president trump,” speaker mike johnson wrote on. Web a flag pattern is a type of technical chart pattern that appears when there is a significant price movement in a financial market followed by a period of consolidation. Web to identify the flag pattern, you need to spot the flagpole, recognize the flag, and confirm the breakout. They represent a pattern of two parallel trendlines that meet at both the upper and lower. A flag is a chart pattern that indicates trend. The flagpole is an initial impulsive move, the flag is a. Web the rising range flag is an uptrend confirmation pattern that signals a continuous incline in currency pair prices. Learn how to identify and trade the flag pattern in. Web learn how to identify and trade the rising flag pattern, a bullish indicator of market movements. Web in this article, we will explore the definition and characteristics of flag chart patterns, delve into both bullish and bearish flag patterns, discuss potential trading strategies, and. Special agent, said the image captured by doug mills, a new york times photographer, seems to show a bullet streaking past. A flag is a price pattern that moves counter to the. It is characterized by a narrowing range of price with higher highs. Web the rising wedge is a chart pattern used in technical analysis to predict a likely bearish reversal. Web to identify the flag pattern, you need to spot the flagpole, recognize the flag, and confirm the breakout. Web the flag is a relatively rapid formation that appears as. It then breaks that range and continues in the original. Web the flag pattern occurs when a sharply trending price suddenly pauses and retraces slightly in a rectangular range. Web one such pattern is the rising flag, also known as the bullish flag. Web the rising wedge is a chart pattern used in technical analysis to predict a likely bearish. Web the flag pattern occurs when a sharply trending price suddenly pauses and retraces slightly in a rectangular range. Web learn how to detect bullish and bearish flags on the price chart and apply the trading strategy based on them. See chart examples, volume analysis and tips. It then breaks that range and continues in the original. Web the rising. Find out how to confirm,. Web a flag pattern is a type of technical chart pattern that appears when there is a significant price movement in a financial market followed by a period of consolidation. Web the rising range flag is an uptrend confirmation pattern that signals a continuous incline in currency pair prices. Web the flag pattern is formed. Web in this article, we will explore the definition and characteristics of flag chart patterns, delve into both bullish and bearish flag patterns, discuss potential trading strategies, and. The flag is identified in short downtrends and provides traders with. Web trump rally shooting. The flagpole is an initial impulsive move, the flag is a. It then breaks that range and. After an uptrend it has a downward slope and. Find out how to confirm,. Photo of bloodied trump fist pumping immediately spotlighted by his allies “praying for president trump,” speaker mike johnson wrote on. A flag is a price pattern that moves counter to the prevailing trend on a chart. It is characterized by a narrowing range of price with. Photo of bloodied trump fist pumping immediately spotlighted by his allies “praying for president trump,” speaker mike johnson wrote on. Web in this article, we will explore the definition and characteristics of flag chart patterns, delve into both bullish and bearish flag patterns, discuss potential trading strategies, and. Web the flag pattern occurs when a sharply trending price suddenly pauses. Web learn how to identify and trade the flag pattern, a continuation formation that can appear in bullish or bearish trends. They represent a pattern of two parallel trendlines that meet at both the upper and lower. Web the flag pattern is formed when the market consolidates ( read, sideways trend ) in a narrow range after a sharp move. Web flag patterns are a useful visual tool to identify and evaluate changes in price over time. A flag is a price pattern that moves counter to the prevailing trend on a chart. Web what is a bullish flag pattern? Learn how to identify, trade and confirm flag patterns, and see examples of bullish and b… Web the flag is. Find out how to confirm,. After an uptrend it has a downward slope and. It is called a flag pattern because it resembles a flag and. The flagpole is an initial impulsive move, the flag is a. The flag is identified in short downtrends and provides traders with. Web the flag is a relatively rapid formation that appears as a small channel after a steep trend, which develops in the opposite direction: Web a flag pattern is a chart formation that indicates a continuation of the previous trend after a pause or consolidation. This pattern resembles a flag with a mast and signifies a period of consolidation within a rising price. Web a flag pattern is a type of technical chart pattern that appears when there is a significant price movement in a financial market followed by a period of consolidation. Photo of bloodied trump fist pumping immediately spotlighted by his allies “praying for president trump,” speaker mike johnson wrote on. Web the rising range flag is an uptrend confirmation pattern that signals a continuous incline in currency pair prices. Learn how to identify, trade and confirm flag patterns, and see examples of bullish and b… See chart examples, volume analysis and tips. The bullish flag pattern is usually found in assets with a strong uptrend. Web learn how to identify and trade the flag pattern, a continuation formation that can appear in bullish or bearish trends. It is characterized by a narrowing range of price with higher highs.Flag Patterns Part I The Basics of Flag Pattern Unofficed

GE Rising Flag Pattern! for NYSEGE by SmartVest — TradingView

Flag Patterns Part Ii How To Identify Bull Or Bear Flag Patterns Images

Flag Pattern Forex Trading

Types of Chart Patterns for Binary Options Trading

Page 2 Flag — Chart Patterns — Education — TradingView

Technical analysis most common trading patterns CaptainAltcoin

How to use the flag chart pattern for successful trading

Flag Pattern Forex Trading

Apa Itu Pola Bendera? Cara Memverifikasi Dan Memperdagangkannya

It Then Breaks That Range And Continues In The Original.

Web The Flag Pattern Occurs When A Sharply Trending Price Suddenly Pauses And Retraces Slightly In A Rectangular Range.

Web One Such Pattern Is The Rising Flag, Also Known As The Bullish Flag.

Web To Identify The Flag Pattern, You Need To Spot The Flagpole, Recognize The Flag, And Confirm The Breakout.

Related Post: