Triple Bottom Pattern

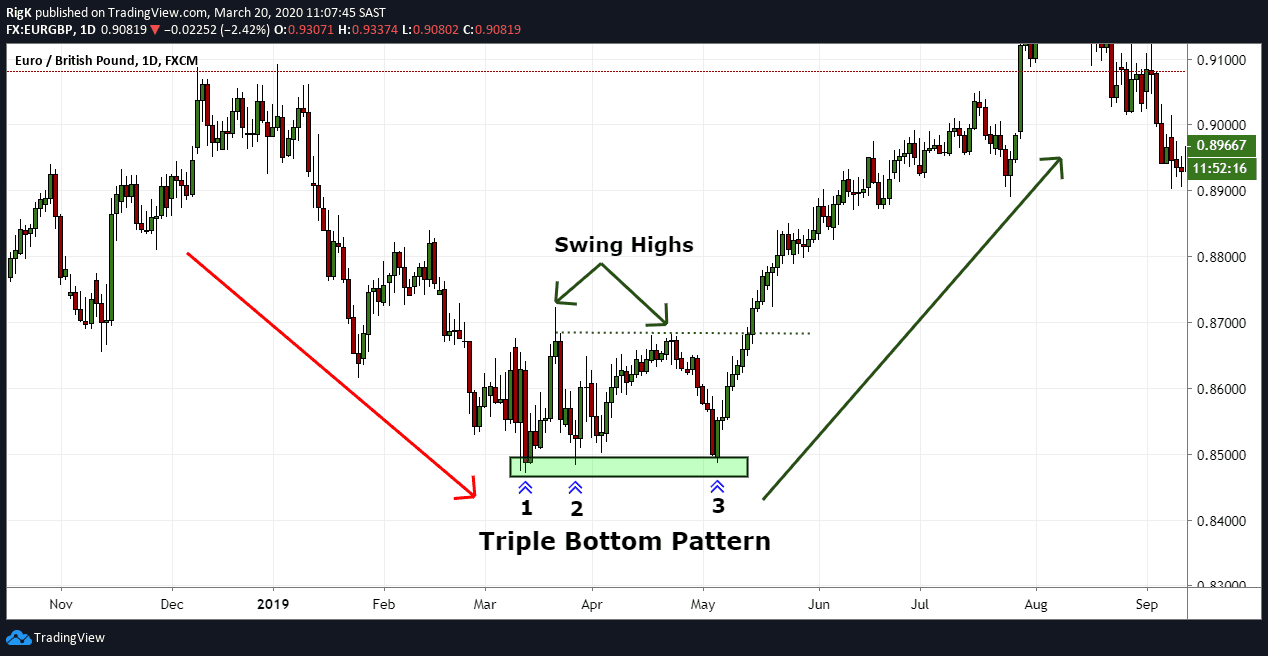

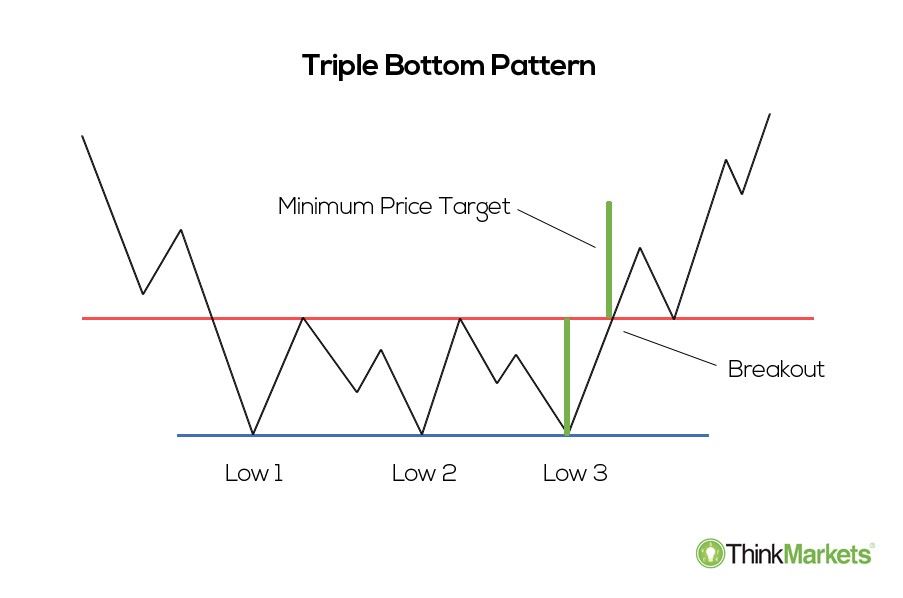

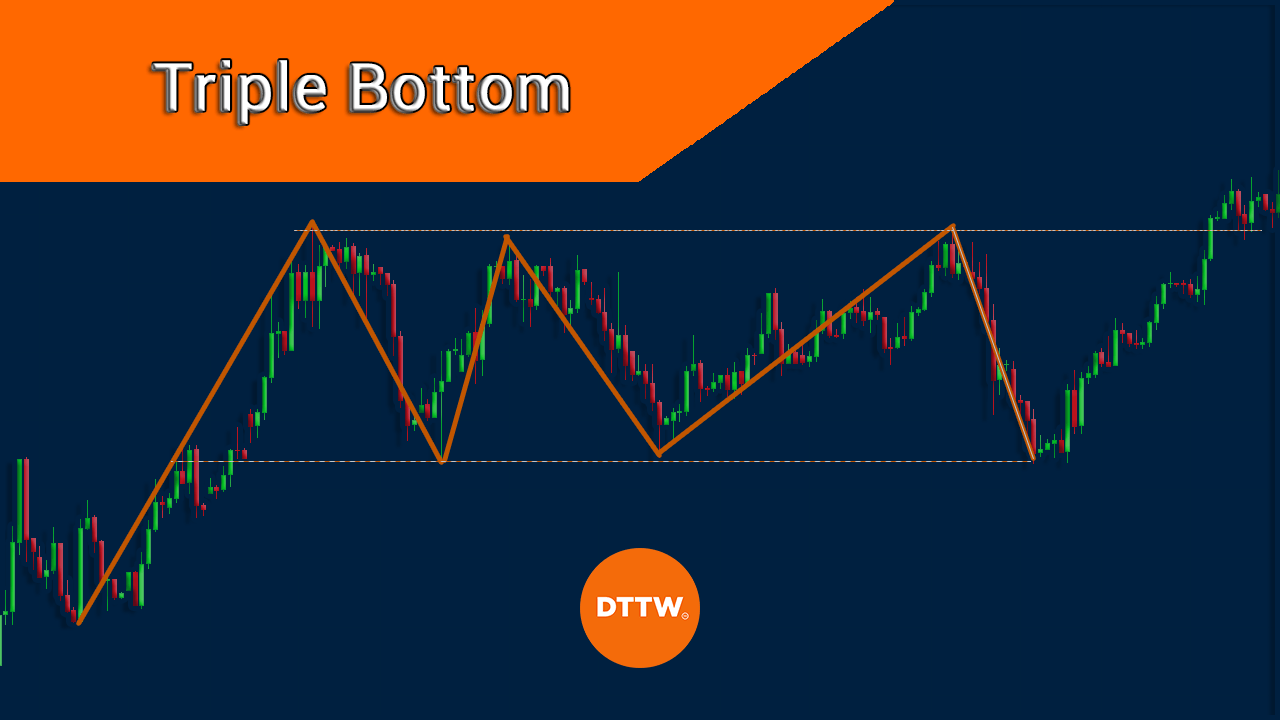

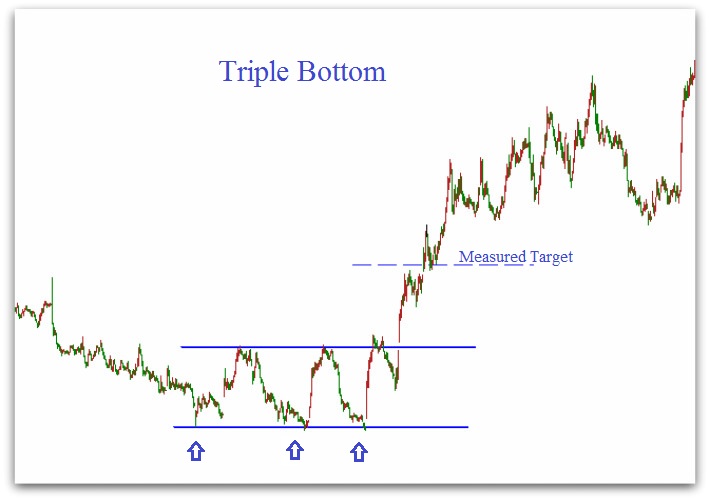

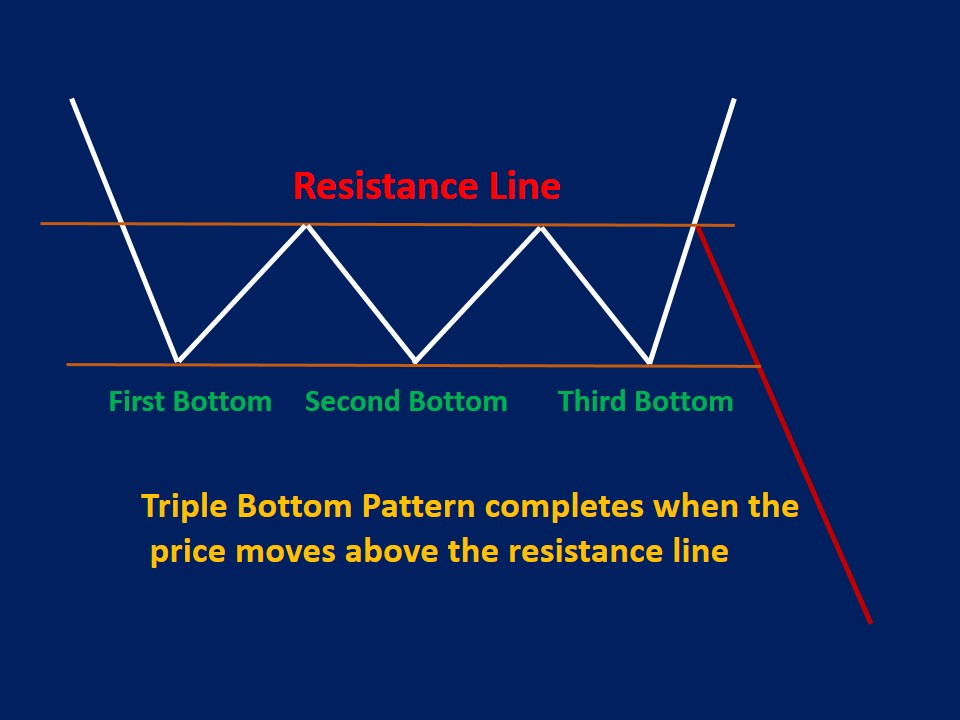

Triple Bottom Pattern - Web a triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers. Web what is the triple bottom pattern? Chicago’s front office is still in a holding pattern to see if the team. Web a triple bottom pattern is a bullish pattern that has three support levels that bears fail to break. The triple bottom chart pattern is. Web the triple bottom pattern is a hot topic in technical analysis, signaling potential market reversals from a downward trend. The chart pattern is easy to identify, and its results. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. The pattern appears on a price chart as. Web a triple bottom is a bullish reversal chart pattern that forms after a downtrend. It signifies a potential trend reversal and a shift from a bearish sentiment to a bullish one. The pattern appears on a price chart as. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web the triple trough or triple bottom is a bullish pattern in the shape of a wv. It is identified by three distinct troughs that occur at approximately. Web a triple bottom is a bullish reversal chart pattern that forms after a downtrend. Web a triple bottom pattern is a bullish reversal chart pattern that is formed at the end of a downtrend. The pattern appears on a price chart as. Web a triple bottom pattern is a bullish pattern that has three support levels that bears fail to break. Web a triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers. Web a triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers. Web a triple bottom pattern is a bullish reversal chart pattern that is formed at the end of a downtrend. Web the triple bottom pattern is a hot topic in technical analysis, signaling potential. In this article, we have looked at some of the most important parts of. Web a triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers. It consists of a neckline and three distinct bottoms,. Web what is the triple bottom pattern? Chicago’s front office is. This is a sign of a tendency. Web the triple bottom pattern is a bullish reversal formation that appears after a sustained downtrend. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web the triple bottom pattern is a useful and reliable bullish reversal. Think of this pattern like a trusty ally that nudges you,. It consists of a neckline and three distinct bottoms,. Web the triple bottom pattern is a bullish reversal formation that appears after a sustained downtrend. It is identified by three distinct troughs that occur at approximately. Web a triple bottom pattern is essentially the inverse of the triple top. Web a triple bottom pattern is a bullish pattern that has three support levels that bears fail to break. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Enter long when price breaks the peak. The pattern appears on a price chart as. Web. Web the triple bottom pattern is a bullish reversal formation that appears after a sustained downtrend. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web the triple bottom pattern is a strategy used by traders to capitalize on bullish momentum. Web it was. Enter long when price breaks the peak. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web a triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers. Web a. Much like its twin, the triple top pattern, it. Its formation and characteristics are the same, but the other way around. The pattern appears on a price chart as. Web a triple bottom is a chart pattern used for technical analysis, which shows the buyers are taking control of the price action from the sellers. Chicago’s front office is still. It consists of a neckline and three distinct bottoms,. Web the triple bottom trading pattern is a measure of the amount of control buyers have over the market price in relation to the sellers. Web triple bottom is a reversal pattern formed by three consecutive lows that are at the same level (a slight difference in price values is allowed). Enter long when price breaks the peak. It involves monitoring price action to find a distinct pattern before. Web a triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance. Web the triple bottom trading pattern is a measure of the amount of control buyers have. Web a triple bottom pattern is a bullish pattern that has three support levels that bears fail to break. The chart pattern is easy to identify, and its results. The pattern appears on a price chart as. Enter long when price breaks the peak. Web the triple bottom pattern is a bullish reversal chart pattern in technical analysis that indicates a shift from a downtrend to an uptrend. Web the triple bottom pattern offers a second chance for traders who missed the double bottom opportunity. Web a triple bottom is a bullish reversal chart pattern that forms after a downtrend. Web the triple bottom pattern is a useful and reliable bullish reversal pattern that is quite rewarding when correctly traded. Web a triple bottom is a bullish reversal chart pattern found at the end of a bearish trend and signals a shift in momentum. Its formation and characteristics are the same, but the other way around. Web the triple bottom is a bullish reversal pattern that occurs at the end of a downtrend. Web a triple bottom is a bullish chart pattern used in technical analysis that is characterized by three equal lows followed by a breakout above resistance. The pattern appears on a price chart as. It consists of a neckline and three distinct bottoms,. Web triple bottom is a reversal pattern formed by three consecutive lows that are at the same level (a slight difference in price values is allowed) and two intermediate highs between. The pattern appears on a price chart as.Triple Bottom Pattern Explanation and Examples

Reversal Candlestick Chart Patterns ThinkMarkets

Triple Bottom Pattern Chart Formation & Trading Strategies

Triple Bottom Pattern, Triple Bottom Chart Pattern

Triple Bottom Pattern A Reversal Chart Pattern InvestoPower

How to trade Triple Bottom chart pattern EASY TRADES

How To Trade Triple Bottom Chart Pattern TradingAxe

Triple Bottom Pattern How to Trade & Examples

The Triple Bottom Pattern is a bullish chart pattern. It occurs

How To Trade Triple Bottom Chart Pattern TradingAxe

This Is A Sign Of A Tendency.

In This Article, We Have Looked At Some Of The Most Important Parts Of.

It Appears Rarely, But It Always Warrants Consideration, As It Is A.

Web A Triple Bottom Is A Chart Pattern Used For Technical Analysis, Which Shows The Buyers Are Taking Control Of The Price Action From The Sellers.

Related Post: